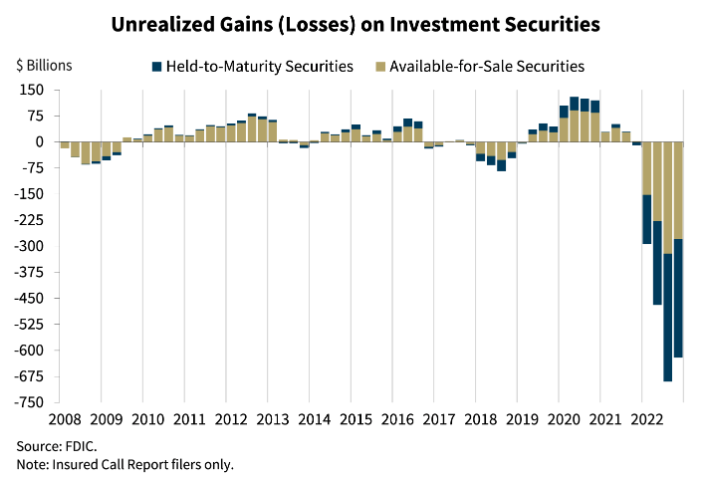

As part of the FDIC QBP released on 2.28.23, the chart below showed a dramatic swing in unrealized losses in the Available-for-Sale and Held-to-Maturity Securities in bank investments.

At first glance, so what? Its an unrealized loss of [likely] longer duration T-bills/bonds paying a fixed rate below what one can get from T-bills today given then sharp rise in interest rates. This isn’t surprising, right? If I were to purchase a bond paying 3% when rates are up are 5-6% then i’ll certainly be paying below par. Initially that’s all that this chart told me.. rates are up.

The context below this chart given by the FDIC is so important. The final sentence says “The combination of a high level of longer–term asset maturities and a moderate decline in total deposits underscores the risk that these unrealized losses could become actual losses should banks need to sell securities to meet liquidity needs”

So if i’m a bank, unless I run into liquidity issues, this is not a problem.

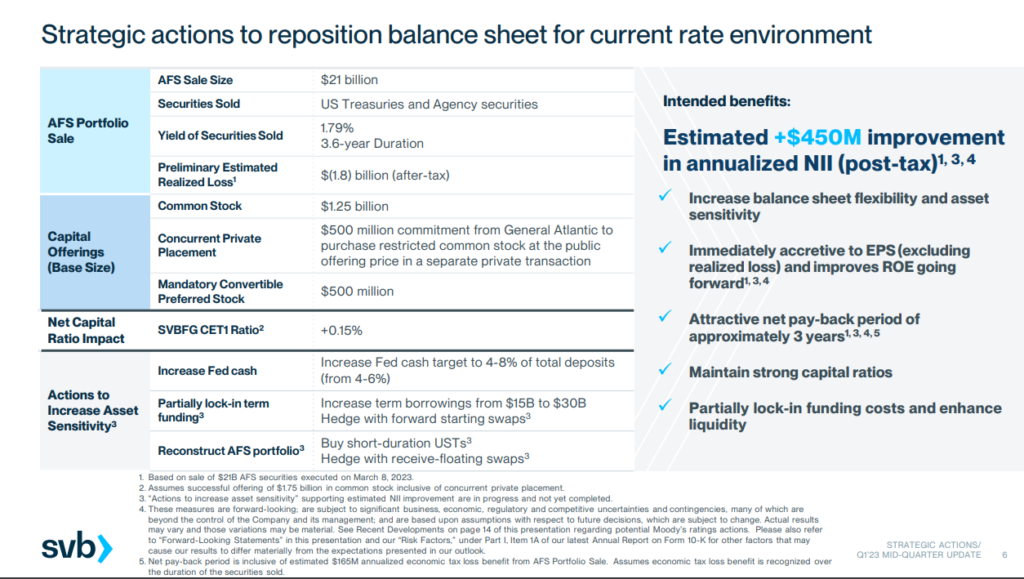

Right on queue, SVB announces moves to strengthen their balance sheet and protect NIM, NII, and profitability. These moves include:

- Selling all of the Available for Sale securities portfolio (remember these were unrealized losses, now they are real)

- Aiming to raise $2.25 billion in common equity and mandatory convertible shares.

Its a bold move to increase liquidity in their balance sheet in anticipation of bumpy weather in the future. The announcement linked above has several good slides but the below is my favorite. Their direction is clear and I suspect they will benefit from being first movers in this direction.