Forcing my self to push through a bit of a writers block, lately I’ve be ingesting information much more than I have been talking or writing about what i’m reading. I’ve enjoyed this time, while acknowledging the intent of this blog was to write even when I dont feel like writing and I want to stick to that intent.

Events that have passed that i’ll need to circle back on:

- Q3 Banking Earnings kicking off this week

- The Fed dropped rates 50 bps (and the 10Y rose, making look like the 10Y/2Y would re-invert)

- FDIC Q2 Quarterly Banking Report

Below i’m exploring what I expect to be the inevitable, agent machines communicating with other agent machines, whether that be between borrower and bank or internally within organizations. I will intentionally avoid using the term ‘AI’ because it’s blanket usage is distracting without providing precise use cases or examples.

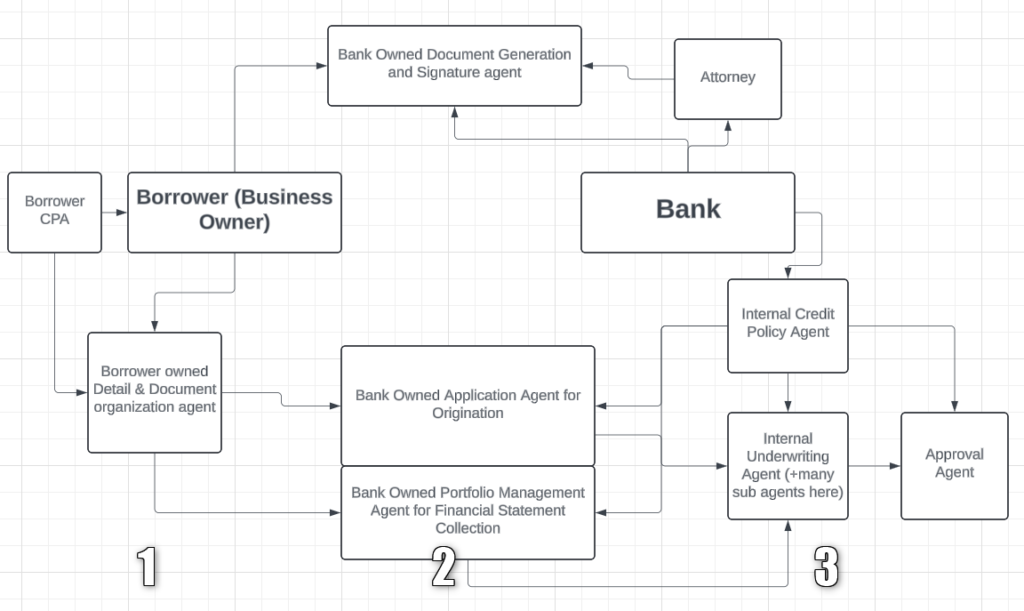

The above is a high level version of what I expect the commercial lending experience to look like in the future, across both borrower and bank workstreams. I see 3 ‘Types’ of Agents based on who they are interacting with in a future state commercial lending experience:

- Borrower representative agent(s), owned by the business owner to communicate with the banks ‘agents’ in the form of document collection or application completion. This agent also allows the borrower to communicate with multiple banks, simultaneously with little effort.

- Bank representative agent(s), owned by the bank and communicate with the Borrower (or their Agent) to complete Application requests for data or documentation, as well as re-occurring document requests as part of existing covenants for outstanding credit.

- Internal Bank Agents, owned by the bank to speed up the process from app to decision to booked. The hierarchy and detail goes much deeper than my visual represents but I think the head of these agents should be the credit policy, and that in turn would require credit policies to possibly be re-written, to provide more detail and use that sole document to drive the rest of the agents within that bank that automate processes.