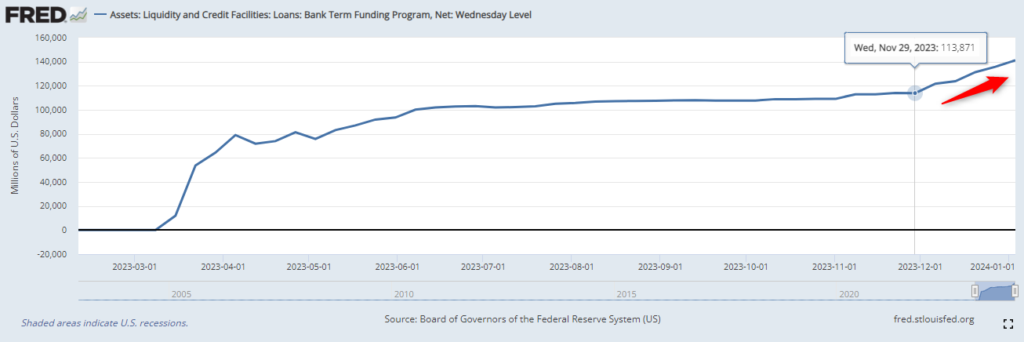

Outstanding’s of the Bank Term Funding Program held steady from June to December of ’23, but are up ~24% since December. Total outstanding’s are now at ~$141 billion.

The intent of the program was protect depositors, the idea being banks could leverage this program to shore up capital if deposits were called vs needing to sell for a loss out of their underwater securities portfolio. There’s no doubt this program brought needed stability to the US banking system.

The program was intended to allow advances until March 11, ’24 with a term of up to a year. So the program will stop advancing soon, with outstanding’s remaining (max) until March 11, ’25

So does this increase in outstanding’s since December indicate stress in some form? The Fed has signaled cuts for next year which will improve the position of those banks with large unrealized losses in their AFS and HTM portfolios.

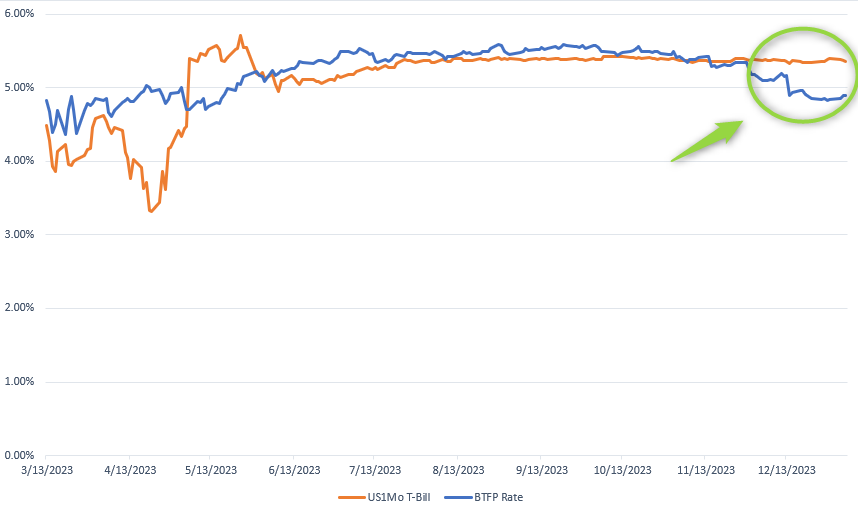

If it doesn’t indicate stress, are these banks taking advantage of the widening spread between the rate at which they can borrow from the Fed and the rate they can buy treasuries from the Fed?

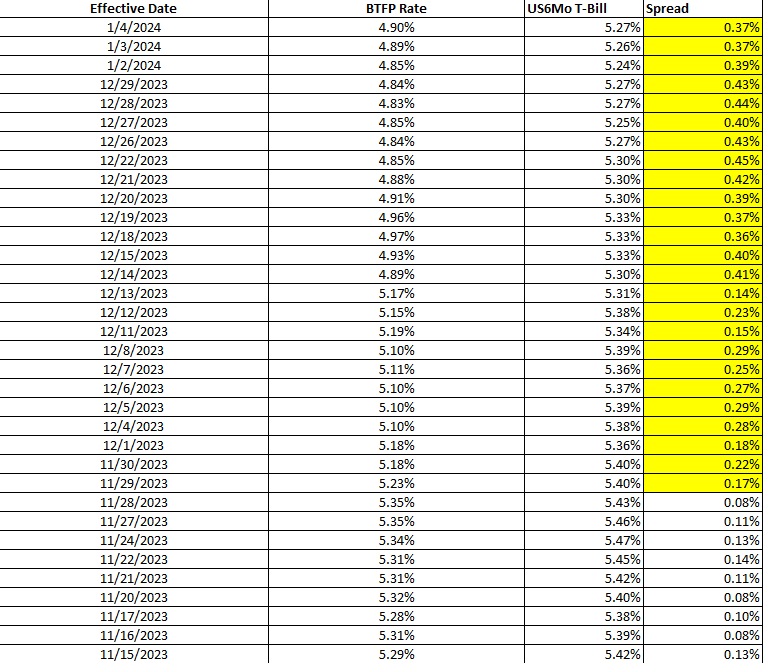

Historical rates for the BFTP can be found here and remember this rate is fixed for the term of the loan. I plotted this over both the US 1 Month T-Bill and US 6 Month T-Bill. Any bank taking advantage of this strategy in the last month would enjoy a risk free spread of ~20-50 bps. They would let the T-Bill mature, pay back the BFTP advance, and enjoy the spread locked in at time of purchase.

If we zoom in on the 6 month spread…

In a world of compressed NIMs driven by challenges with cost of funds and loan demand (and likely credit concerns around CRE coming), the real question is who wouldnt be taking advantage of this?