On December 18th the FDIC issued a Financial Institution Letter highlighting the “importance of strong capital, appropriate credit loss allowance levels, and robust credit risk-management practices for institutions with commercial real estate (CRE) concentrations.”

The timing of this letter felt strange for a couple reasons, and I contest that may have been the intent of the author, Doreen Eberly

Remember on December 13th, a rather bland, but positive FOMC Statement was released – the highlights:

- Economic growth is slowing, jobs remain strong, unemployment remains low, U.S. banks are resilient [!], we will hold the fed funds target rate at 5.25 – 5.50

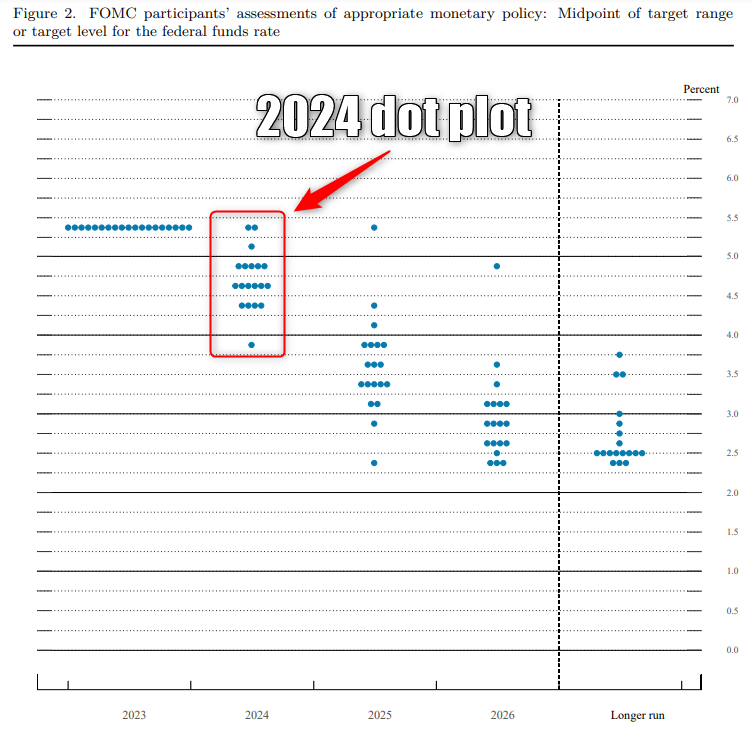

Then Chair Powell spoke and in a dovish, semi-pivot, pointed to tame GDP growth predictions for ’24 (median projection at 1.4%), that we may be in a recession currently, the need to cut prior to inflation getting down to 2%, and the Summary of Economic Projections showing a fed funds cut of 75bps in ’24. Powell was quick to explain the SEP is just a culmination of what people wrote down. Its not a plan, its not debated, its not discussed.

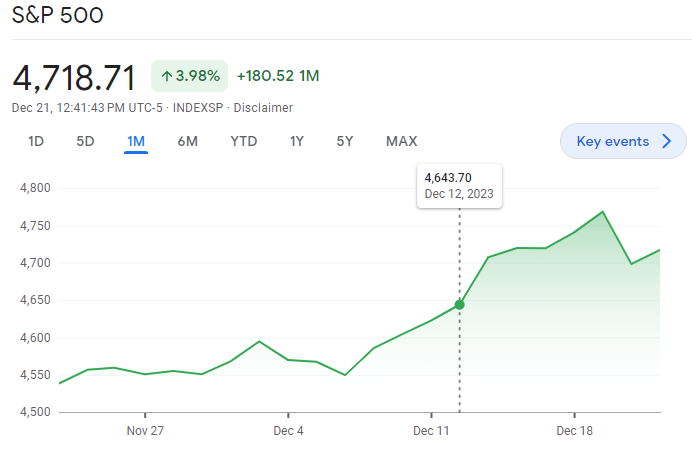

And the market heard exactly what they wanted to hear. The broader market was up:

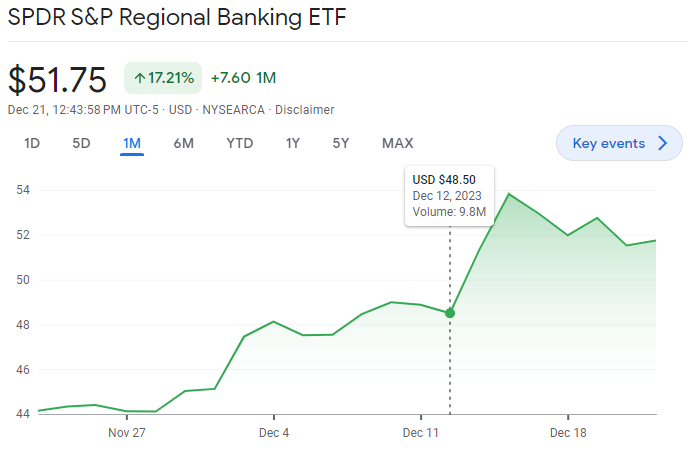

Heavily battered regional banks were up:

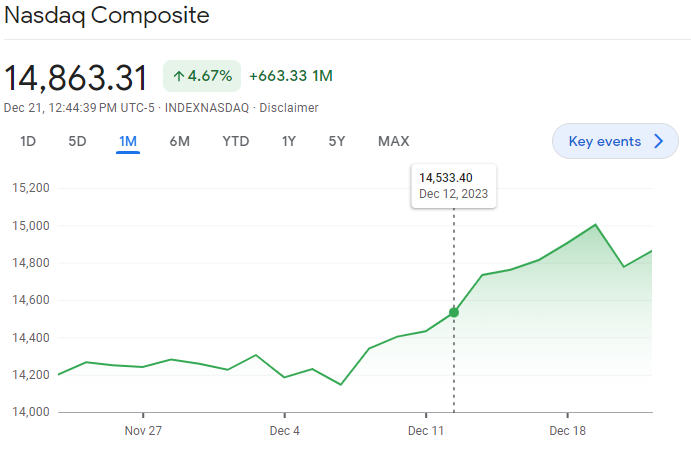

Technology was up:

[homebuilders also worth looking at here]

but back to the timing of the FIL on CRE Risk and how the timing is important. It’s almost as if the market started pumping their fists in the air chanting ‘victory’, but its too soon to celebrate and those impacted by Chair Powell’s comments wanted to make it clear that there are still lingering risks to monitor. CRE office risk has been a theme in ’22 & ’23 but there was a multi-family call out that felt new. Directly from the FIL – “

“The multi-family sector vacancy rate is also high in some markets, due in part to potential overbuilding. Rapid absorption of multi-family space experienced in 2021 has since slowed, while the pace of new construction remains brisk.”

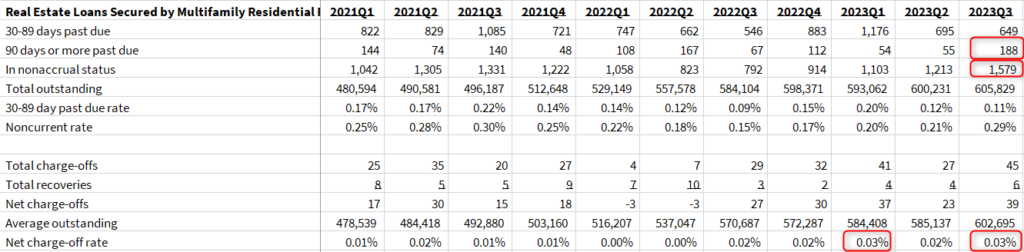

Pulling data from the Q3 ’23 Quarterly Banking Profile, net charge offs are up for multi-family:

I contest its difficult to worry about a .03% net charge off rate, but it is a 9 year high.

This is what leads me to think this FIL was some cautionary news timed to pad excitement in an elated market. The mutli-family market may be sliding, vacancy rates being the leading indicator, but data from Q’3 is not cause for concern.