As we enter Q1 24 bank earnings season, I expect to see continued commentary around interest rate pressure; increasing costs and stagnat loan demand… but I also expect the tone to shift.

The sentiment back in January ’24 was that rates had peaked and Q1 would still be challenging but Q2, Q3, and Q4 would enjoy the shift of rates decreasing, costs decreasing, and loan demand starting to bounce back. This would relieve pressure on NIMs and overall the thought was “brighter times ahead”

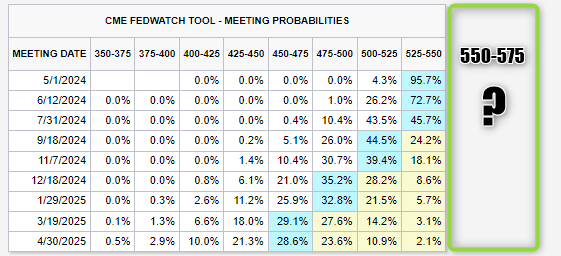

With hot-ish CPI this week and a couple Fed meeting with J Pow saying more time is needed, I would argue the chances of rates going UP is >0%. We don’t see this in our CME Fed Watch, but it should be there.