Marty Gruenberg is back with the Q1 QBP, and while I was eager to see data based evidence of a shift in banking to support the observational shifts we’ve all seen in headlines as of late, I realized this data is already stale.

Marty was quick to call this out immediately – “…these results, especially for earnings, include the effects of only a few weeks of the industry’s stress that began in early March, rather than over the course of the entire quarter. The more lasting effects of the industry’s response to that stress may not become fully apparent until second quarter results.”

We know the instability that entered the banking sector late in Q1 was a liquidity problem, not a credit problem, as is the traditional risk we think about in banking health.

Is credit next?

Looking through the QBP I aggregated a couple references to credit quality that we may not actually see until later on:

- Marty’s remarks at the end of his intro – “Credit quality and profitability may weaken due to these risks and may result in a further tightening of loan underwriting, slower loan growth, higher provision expenses, and liquidity constraints. Commercial real estate portfolios, particularly loans backed by office properties, face challenges should demand for office space remain weak and property values continue to soften. These will be matters of ongoing supervisory attention by the FDIC. “

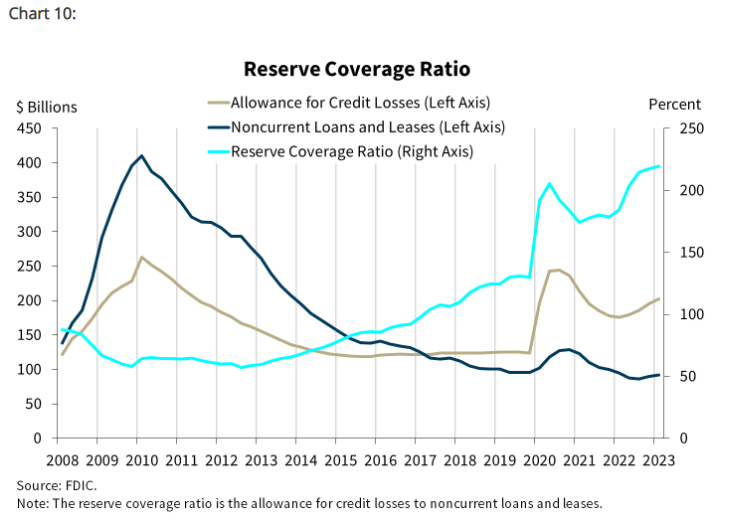

- The highest Reserve Coverage Ratio on QBP record

The above signals the expectation of credit deterioration. Last year this ratio was at 184.3% meaning $184.30 was set aside to cover every $100 in noncurrent loans and leases. This ratio is now at 219.5% signaling the noncurrent loan and leases levels are expected to rise.

So again, we wait for the availability of data that matches the timeframe of our experience. It remains difficult to decouple recent experience with data proven stale by the velocity in which a sector can change.