ADP Released their June 2023 change in U.S. private employment this week and it came in hot, adding 497,000 jobs vs the 220,000 estimate.

The market reacted negatively, as the likelihood of the Fed continuing to raise rates increases as job growth helps fuel inflation.

Given this increase was largely driven by leisure and hospitality (232,000 new hires), wouldn’t we expect this to be relatively seasonal? The consumer is still spending, service based roles have had trouble hiring the past couple years, but are those workers who sat out of the labor market recently, now coming back due to savings dwindling? From the above perspective, the increase in leisure and hospitality doesn’t surprise me from May – June.

Where I am surprised – 97,000 jobs added in construction. We would expect construction to be decreasing in a rising rate environment.

Staring down the barrel of a project paying interest only and needing to flip to perm once stabilized… terrifying at these rates. Some thoughts on what could be driving this:

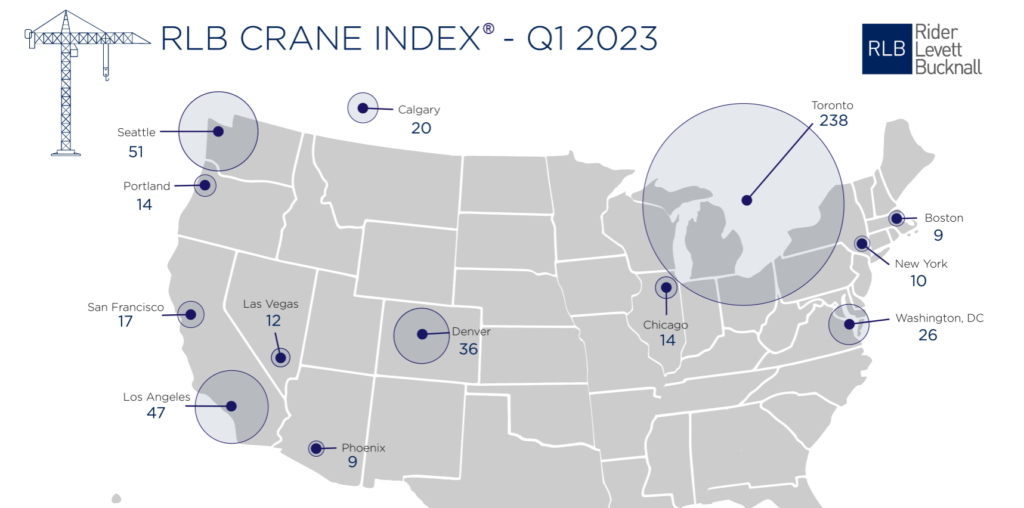

- Projects are worried about the now and right now many cities have cranes in the sky. The interest only costs are rough but bearable, much like lumber costs were rough but bearable in the recent past. The cost trade in construction has moved from supplies to cost of capital and things are still moving.

- Projects started when capital was cheap are nearing completion and they are pushing to complete these projects prior to rates rising further.