Our fearless leader, FDIC Chairman Martin Gruenberg, has spoken.

As time goes on I appreciate more the choice of words from those in leadership roles as they will inevitably be thrust under a microscope and analyzed/ over analyzed/ brought up in the future as a ‘gotcha’….all of this to say how well written this QBP was.

In reading the release, my first thought is “where is the weakness?” Macro headlines are full of recession fear, almost as if we are wishing it into existence, but now that we have some meaningful data, what does it indicate?

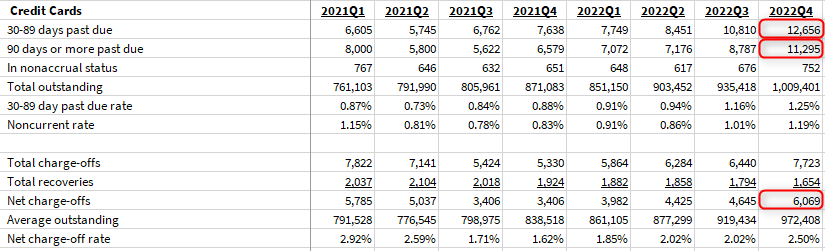

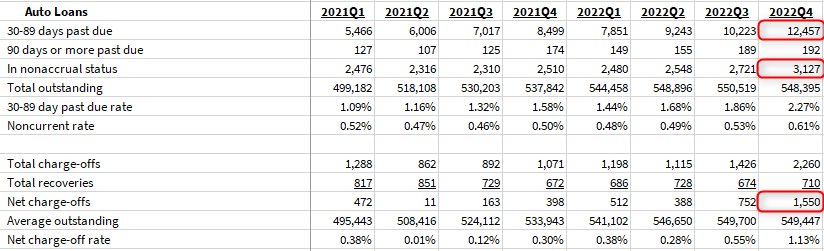

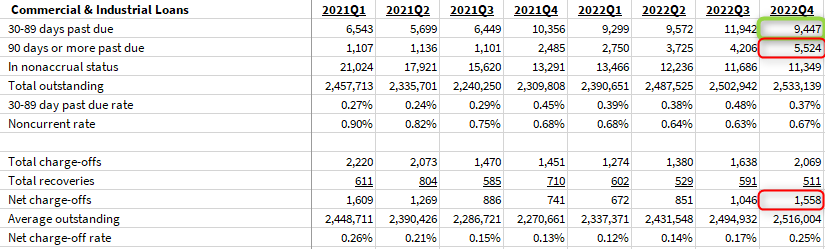

The answer is trends are beginning to shift negative in retail lending around 1-4 family homes, credit cards, and auto loans, with another call out to C&I lending. That is to say:

“Despite the increases in noncurrent and delinquent loans, credit quality metrics remain better than pre–pandemic averages. Nonetheless, the trends could be an indicator of future asset quality problems and will be an area of continued supervisory monitoring.”

Starting with the credit card numbers:

Next, auto loans:

C&I Lending:

Consumer spending strength has been hailed in the last year despite a higher market rate environment, but these numbers tell me we are beginning to touch the limits of what the consumer can handle. And what happens when consumers stop spending? Asset prices fall.

More to come.