The almighty Jerome Powell addressed congress today as part of the Federal Reserve’s Semiannual Monetary Policy Report.

He first covered the Current Economic Situation and Outlook:

- He’s surprised to see employment, consumer spending, manufacturing production, and inflation data reversing softening trends seen recently. (He blames the early Spring weather?)

- Inflation is still too high in Housing Services and Core Services and in order to cool this, he’ll induce a softer labor market (with rate hikes).

- Although the US economy has slowed measured by GDP, the labor market is still too strong; 1.9 job openings for every unemployed individual, close to an all time high.

Second, he covered Monetary Policy:

- Multiple references to the 2% inflation target and reinforcing his intent to reduce the size of the Fed’s balance sheet

- Interest sensitive sectors of the economy are seeing the impacts of higher interest rates and the rest of the economy will lag

- He enforces the Fed has a long way to go to get inflation back to 2%, it will be “bumpy” ?, and current economic data suggests “ultimate level of interest rates is likely to be higher than previously anticipated”

How did the market react? Large banks were down on the day:

- JPM -2.94%, BAC -3.32%, Citi -2.11%, WFC -4.68%, USB -3.32%, PNC -4.56%, TFC -4.56%, GS -3.07%

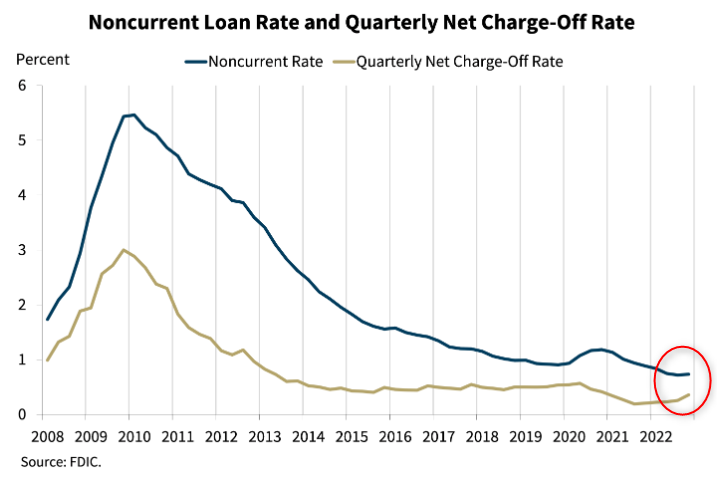

We saw in the FDIC year-end ’22 numbers that retail portfolio’s are experiencing increased, although not alarming, charge-offs in auto and credit card lending, as well as pressure on deposit costs due to competition and the bank’s need for capital. JPow leaning more hawkish heightens the risk of credit degradation for those with variable rate notes, leads to tightened lending standards, and increased loan loss provisions, which will all impact capital/ liquidity negatively. For those risks to bank profitability in the future, the sell off on the day took place.