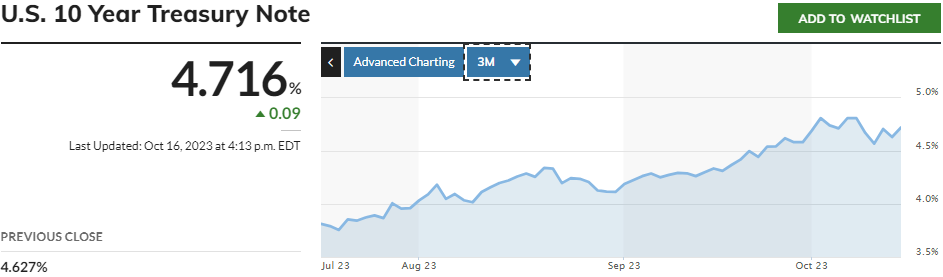

As we roll into Q3 bank earnings after knowing the 10Y yields spiked in the last couple of months, the question(s) become:

- are banks now being forced to sell their AFS’s at a deep (now realized vs unrealized) discount to shore up capital?

- are deposit outflows driving the need to shore up capital, and how widespread is this problem?

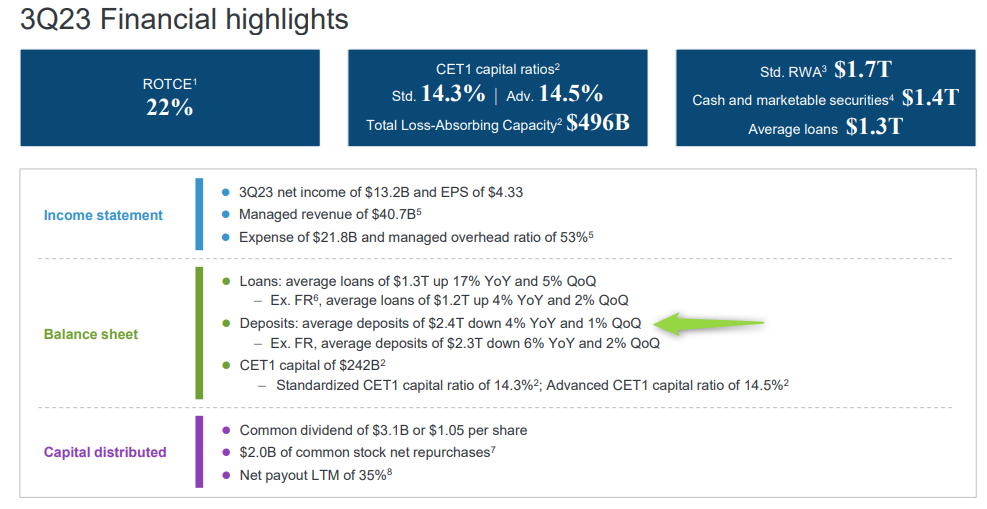

Its difficult to find any issues in reading through JPM’s Q3 earnings. This thing is an absolute juggernaut, and capital issues are not a problem. But it is worth noting a 4% decline YoY in deposits firmwide. A huge $ number, and while not a problem for JPM, likely a problem for some other banks should that % decrease in deposits be industry wide and not just specific to them.

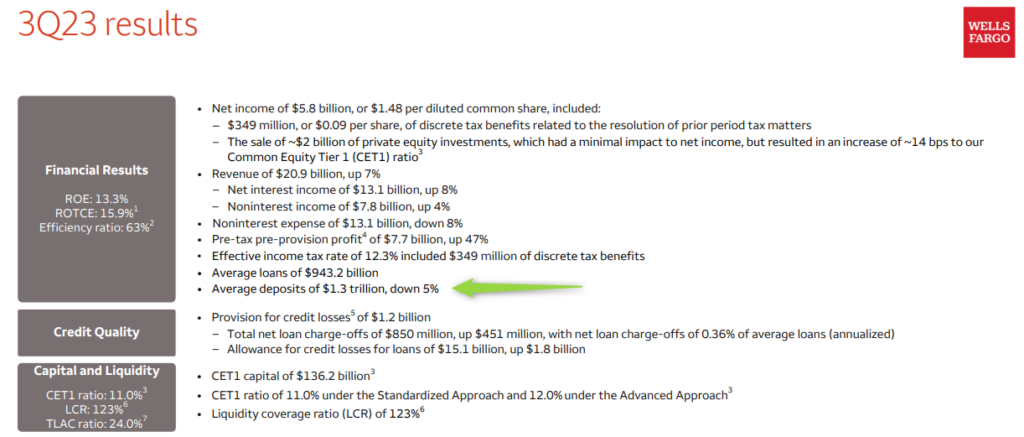

Wells Fargo Q3 earnings is seeing a similar trend. Average deposits down 5% YoY

Citigroup is also seeing deposits leave, but is the lesser of the 3 that reported

While I dont think these larger lenders are at risk, the question remains that if deposits are leaving across the board, there are regional lenders that will be forced to look elsewhere for capital, all while charge-offs are on the rise, also increasing the need for capital. What are the realistic options?

- Raise equity (SVB attempted to do this and failed)

- Sell assets (like those underwater instruments in AFS and HTM portfolios)

This is where the forced Great Mark to Market could start to unfold. Given liquidity and capital pressure, we will be forced to understand the value of assets that have to be sold to save the balance sheet in a time of necessity.