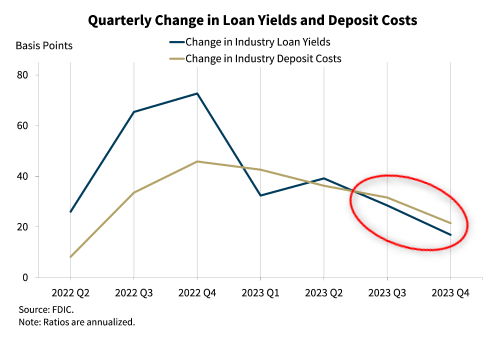

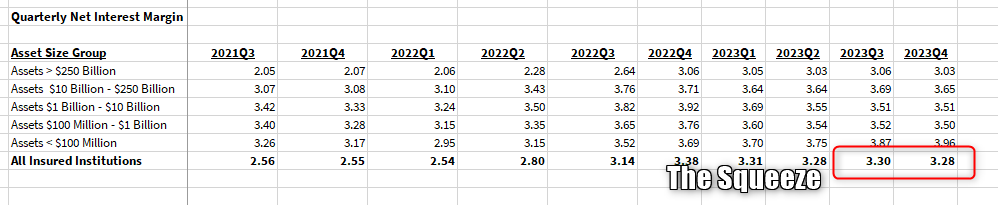

A common theme in the Q1 24 earnings announcements so far is interest income yields are rising, but not as fast as deposit costs are rising. The FDIC called this out in their Q4 23 QBR.

At the time of publication this represented two consecutive quarters of deposit costs increasing faster than loan yields, and based on Q1 24 earnings so far, were headed for three consecutive quarters. The reason isn’t necessarily deposit flight (like we saw last year) but non-interest bearing account to interest bearing account movement. Think of $ movement from a checking or savings account to a CD or money market in search of yield. Banks will offer these products because maintaining deposit balances is important and if they aren’t offered a % of their deposit base will leave.

It’s worth noting that loan yields aren’t falling, they are still increasing as you’d expect in a higher rate environment due to variable rates and increases in credit card outstanding’s by a strong consumer base. It’s not increasing enough… commercial loan growth/demand has stagnated while consumer portfolios have grown.

Where does relief come from? The FDIC ended its commentary on the above chart with a gem: “A pivot to lower market interest rates could reduce the pressure on bank funding costs, but the timing of any changes in rates is highly uncertain.”

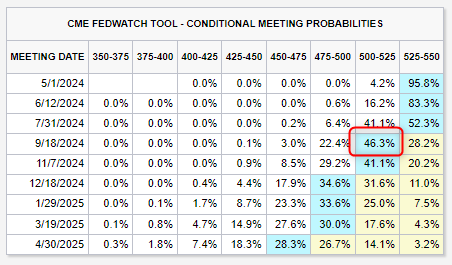

Probabilities of a rate drop, which would alleviate pressure on bank funding costs, change often, but as it sits today we are looking at the September time frame…

If this were to hold true, deposit cost pressure will maintain in Q1, Q2, & Q3. An increase in loan demand would help the interest income side of the equation, and renewals (repricing) helps here too. As said, the timing of these changes is highly uncertain so this work is more of an exercise and less of a prediction.