I went to check out a live recording of the Compound & Friends in Charlotte last night and their guest was Campbell Harvey, Professor of Finance at Fuqua. The episode is excellent; Cam made an argument that real inflation is currently < 2% (minute 30), he was critical of the Fed pausing vs ‘terminating’ rate hikes, and that the best way to avoid a deep recession is to grow the economy (vs raising taxes and/or printing money)

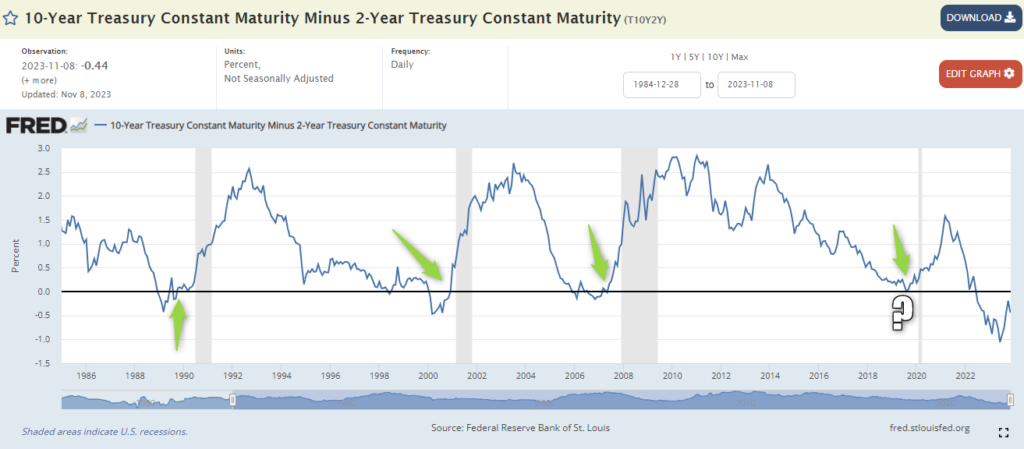

Cam Harvey’s 1986 Ph.D. thesis noted that inverted yield curves predict recessions. At the time he had 4 examples prior to 1986 and since there have been 4 more examples.

The most interesting part of the conversation is, in these examples the recession doesn’t start when the yield curve inverts, but when it un-inverts.

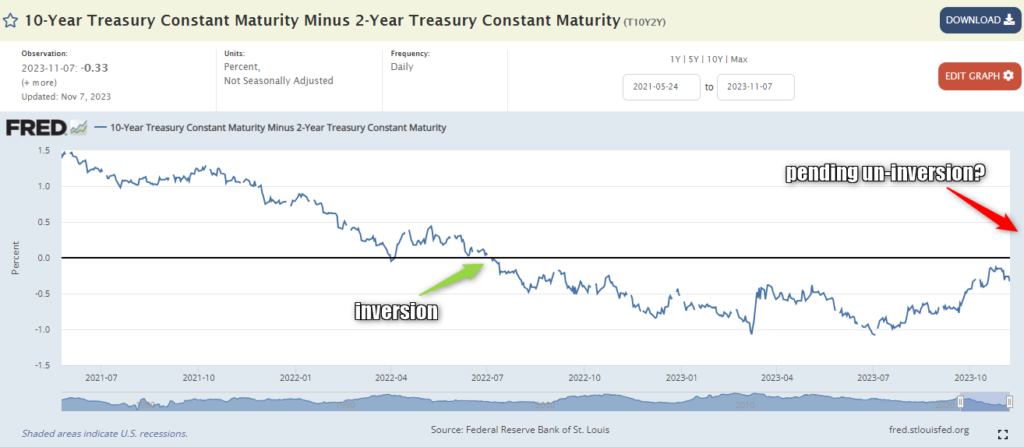

Cam’s work focused on the 3mo/10y curve but today we reference the 2y/10y. Josh Brown presented Jim Colquitts take, that in these scenarios, recessions start on average ~4 months after un-inversion. Lets look at the historical chart for context and where we are today:

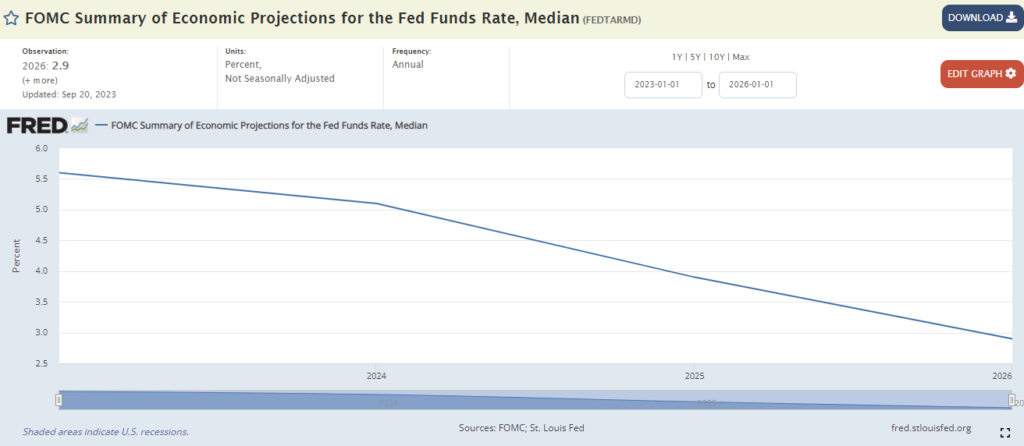

This lines up with predictions of a rate cut in ’24, favoring the second half of the year.

The idea being, a rate cut is meant to balance a cooling economy in say Q2’24, as predicted by (what looks to be) a pending un-inversion in Q4’23 or Q1’24 + ~4 months as noted in the above podcast.

This will be a fun one to bookmark and look back in 6 months!