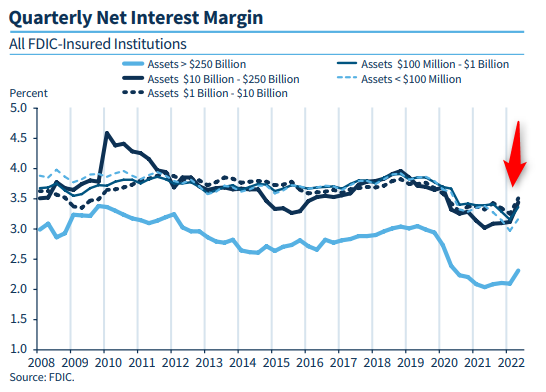

Given increases in interest rates, banks with interest rate sensitive assets (loans to businesses that are variable rate) are experiencing an increase in interest income at a higher velocity than their interest expenses are rising. This is intentional given the increase in interest income expands the Net Interest Margin of that institution. This is not without the pressure of competition. As banks use deposits to fund their activities, customers will have options to move their deposits elsewhere if the bank doesnt raise their interest rate on those deposits. Some argue moving banking relationships is so cumbersome, deposit retention only becomes a concern if competing deposit interest rates are meaningfully higher across the street.