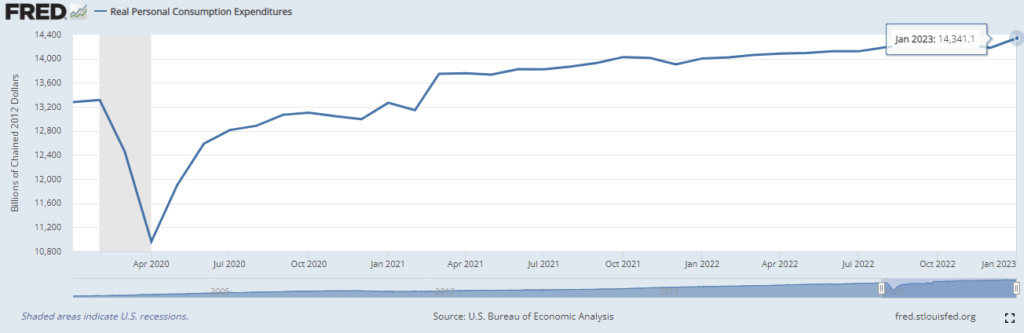

I’ve seen references to the below in different formats, leading to comments like “the consumer just wont quit” and “the consumer is still strong given headwinds”

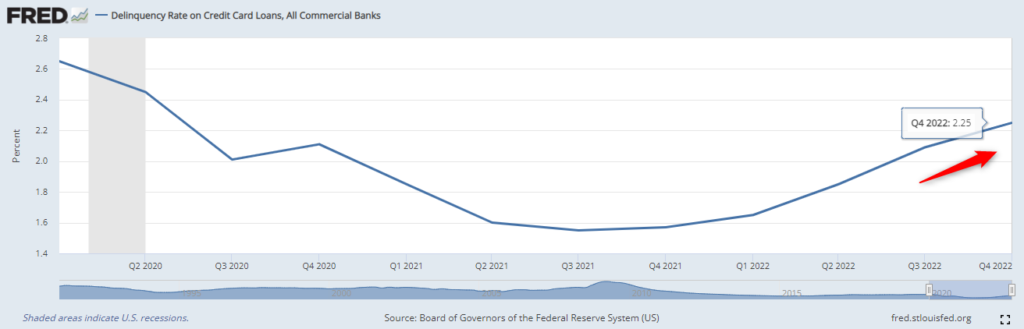

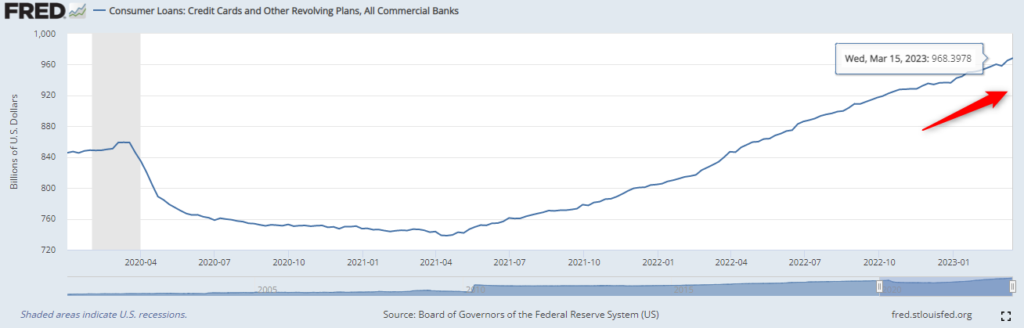

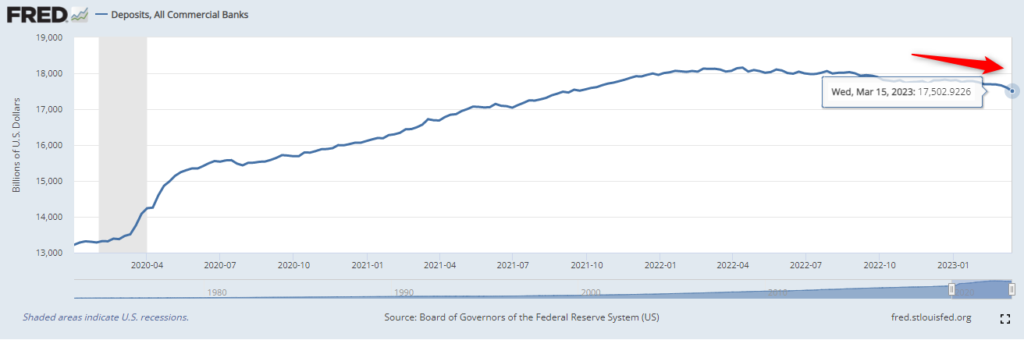

While the chart looks strong, I argue the source of that strength is fading and likely lags other indicators. This strength started in the form of cash spent by the consumer, but as we see deposits shrink and credit card totals outstanding increase, we can assume the consumer is now shifting spending from cash to credit. With most credit cards having a variable rate, I wouldn’t expect the velocity of delinquencies and increases in outstandings to cease until rates begin to decrease.

It’s also worth noting that none of the above values are alarming in the sense of historical values. Each is moving back towards the mean, however my argument is there isn’t anything present to change the direction of these trends. It will likely take a reduction in rates from the Fed, and given Powell’s statements, he is still focused on battling inflation and a strong labor market. I expect all of these trends to continue except real personal consumer expenditure strength as that is precisely what the Fed is battling and may lag other indicators.